Great stocks — those with proven record of compounding return at a satisfactory rate for a long period of time tend to be relatively unpopular within the investment community. The common perception is that they are unlikely to provide a satisfactory return for investors because of a few reasons namely:

- High P/E

- It has been priced in

- Low return

- Boring

High P/E

Most investors tend to shy away from high P/E stocks (P/E 15 and above) because they are not considered ‘cheap’ and put more focus on so-called ‘undervalued gem’, or stocks that trade below PE 10 as these stocks are considered to have higher upside potential if the business continues to perform well while PE expands, say from PE 7 to 10.

It has been priced in

When measured against popular multiples like Price-to-Earnings ratio, Price-to-Book ratio etc great stocks generally sell at a much higher multiples compare to their gem peer. As the reasoning goes, their quality has been priced into the share price. So they’re unlikely to provide a satisfactory return for the investor.

Low return

Because of the inherent quality of these stocks, they are considered low risk and safe. Investors equate low-risk investment with low future return such as fixed deposit. Thus they are unlikely candidates to offer a high return.

Boring

Most investors don’t want to hold great stocks because they are simply unexciting.

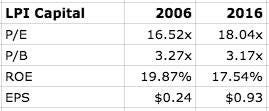

To see how well these reasons hold up, let’s take a look at an example — LPI Capital. LPI Capital is a general insurance company and below is some of their key figures for 2006 and 2016.

LPI is a classic stock that fits the bill of great quality, selling at high P/E and one that’s extraordinarily boring. LPI looks richly valued today as they were 10 years ago, and not what many investors would be willing to own it back then or now. So how did the return looks like over the past 10 years?

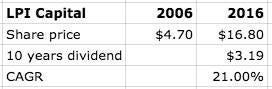

I’m not sure if 10 years compound annual return of 21% is considered ‘satisfactory’ for a common investor, but it is pretty amazing to me (Turning $1 into $6.73). This return easily beats 99% of the stocks out there.

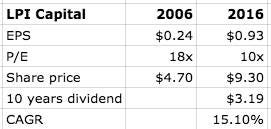

This could be a hindsight bias by singling out a stock that ‘worked’ while ignoring others that have suffered a different fate. Let us consider an alternative future. Suppose LPI Capital today trade at PE 10 instead of 18. A simple EPS calculation would still show you that the 10 years CAGR is around 15% after suffering such a horrendous PE contraction.

We can begin to debunk the myth that owning high P/E stocks is a recipe for disaster. However, this is far from saying that you should go out and start scooping up any high P/E stocks. The nifty fifty lesson remains sound and overpaying too much for a stock does put you at a greater risk. However, when observed from a long time frame, great stocks that can compound at a satisfactory rate of return for a long time will substantially reduce the risk of capital loss as shown by the example above. You can rely on the business quality and time to bail you out if you indeed bought it at a ridiculous overvalued price. The opposite is true for stocks with poor economics. Time is the friend of a great business and the enemy of a poor one.

The 2nd myth that we can debunk is that even if all the information have been factored into the share price, it does not mean superior return cannot be achieved. The long-run compounding rate of a business is a reliable estimate on how much an investor can earn over the long term. LPI Capital’s 10-year CAGR return has been tracking closely to its 15–20% ROE band, plus and minus the entry price of the investor, which matters less and less as the holding time lengthens. Buy price still matters a lot if you have a short investment horizon but the weight gradually shifts from buy price to time on hand the longer you expand your investment horizon. But of course, if you can own a great stock at a cheap price, why not. The key here is investors tend to underprice the long term compounding power of a great stock.

Valuation multiples i.e P/E, EV/EBIT are all shorthands and many times they do not tell the true story of a business. The key here is not about ignoring them, but knowing their limitations. So does every other valuation methods such as DCF. Just as there are many undervalued stocks that never turns, there are also those few great stocks that do not regress back to the average for a long long time. Once you found it, all you need is a lot of patience and let it does its job. And it is much easier to differentiate a great business from poor ones compares to telling whether a stock is under or overvalued.

Write to me at ricky.yeo@musingzebra.com

If you find this helpful please share it and subscribe to our list http://eepurl.com/b93qbH

I enjoyed that read. Thank you. I invest in high growth, high multiple stocks so the content appealed to me.

Good to hear that Joe. Just be careful on the sustainability of the moat. And high growth tend to attract competition, which will drive down profits over time.